2025 BENCHMARKING REPORT

Top Technology Trends in Fuel Delivery

Introduction

Welcome to the 2025 Top Technology Trends in Fuel Delivery Benchmarking Report, brought to you by Cargas. Results from our sixth-annual Tech Trends Survey are in, and we’re excited to share how the industry has evolved since the Benchmarking Report’s inception.

In recent years, energy companies have realized the potential for efficiency gains by embracing a more extensive array of software tools. These companies are actively diversifying their tech stacks, prioritizing new business software solutions, and showing a keen interest in cutting-edge features such as automation, artificial intelligence, and cloud computing.

This report harnesses insights from more than 100 fuel dealers to explore how their technology has evolved year over year. You’ll learn how your organization compares to other energy companies and discover technology for every area of your business.

Adam Harrison | Sales Consultant, Cargas Energy

Trend 1: AI’s role in energy is uncertain—but folks have theories

While 46% of respondents were uncertain of AI’s role in the future of fuel delivery, others addressed the potential for artificial intelligence to impact three main areas (rollover images to learn more):

Delivery

(22%)Delivery

“I think there will be a lot to using AI for delivery routing and possibly with figuring out the delivery demands of our customers.”

“Possibly creating routes based on fuel type and proximity to other tickets using monitor readings to determine which routes are more critical.”

Tank Monitoring

(17%)Tank Monitoring

“We would like to see a software package that will better predict those prone to running dry [compared to] K-factors.”

“Better estimate customer tank level, which will drive delivery fleet efficiency.”

Customer Communications

(7%)Customer Communications

“Based on degree days, reach out to will call customers letting them know their tank is at an optimal level to get a delivery and encourage them to call for delivery.”

“[We’re] using this now in HR and communications/marketing.”

Trend 2: Not everyone is excited for the age of AI

Still, 5% of respondents feel negatively about AI in energy. One respondent noted that AI does play “an ever-increasing role,” but added that it “seems a bit scary that we depend on computers and AI to run our business.”

Similarly, another respondent wrote, “AI within the workforce can lead to complacency. Real humans need to be trained and always alert to be able to act swiftly and effectively in emergency situations. The danger of misinformation is just too great to rely on AI in a HAZMAT industry.”

Trend 3: Tank monitors are paving the way for AI

When asked which AI tools they currently use, 8% of respondents listed tank monitors and K-factors alongside popular generative AI solutions like Samsara, ChatGPT, and Power BI.

This categorization is not entirely accurate—although tank monitors have digitized a once-manual process, they are closer to an automation tool than an AI. However, with the right integrations, AI for tank monitors could evaluate historical data and send alerts about unusual usage. That raises the question, are tank monitors the precursor to AI in fuel delivery?

Why are you using tank monitors?

Number of responses: 102

In 2023, only 69% of respondents increased tank monitor spending. This year, the number grew to 71%, with an additional 14% maintaining existing tank monitor numbers. In total, 86% of respondents actively use tank monitors to reduce runouts (77%), better manage tanks with variable usage (76%), improve delivery efficiency (76%), and monitor tanks in remote locations (74%).

With tank monitors continuing to build momentum, and with AI being introduced to their functionality, it may be a matter of time before AI plays a role in the dispatch process.

Trend 1: Fuel Delivery Software

Almost 88% of respondents use fuel delivery software in some capacity. The data shows an increased urgency to replace outdated software, with a 4% higher rate of respondents willing to replace software as soon as this year compared to our 2024 survey.

Last year, only 6% of respondents had made a fuel delivery software investment within the year. This year’s survey saw that number double, with 12% of respondents having made a recent delivery solution purchase.

As for respondents who would wait 7 or more years to make a software purchase, that number dropped 13% this year, matching the 38% response rate from our 2023 survey. Based on the openness to short-term software investment, and the higher rate of recent fuel delivery system purchases, the energy industry continues to track and implement the latest technologies.

When did you purchase your current fuel delivery software?

Number of responses: 102

When would you consider purchasing new fuel delivery software or replacing your current fuel delivery software?

Number of responses: 102

The remaining 12% of respondents who don’t use fuel delivery software either do not deliver propane or heating oil (25%), feel they don’t need it for operations (33%), or know they want or need the software but are unable to make the investment (42%).

Trend 2: Diverse Tech Stacks

In addition to your fuel delivery software, what other technology do you use to support your business?

Number of responses: 102

93% of respondents use two or more solutions other than fuel delivery software to manage business, with remote tank monitors (77%), office suites (74%), and payroll and HR software (73%) being the most popular software. These solutions share one core commonality—they automate manual processes.

Are you using a mobile solution that is integrated to your back office?

Number of responses: 102

Wireless technology has transformed the fuel delivery industry, allowing back offices and drivers to communicate with minimal downtime. Just over two-thirds of respondents use a mobile solution that is integrated to the back office.

Mobile application usage is down 10% from 2024, now closer to the rates from 2022 and 2023. However, 59% of respondents who purchased fuel delivery software in the past 7 years have built-in mobile applications.

Trend 3: Tank Monitors

Tank monitors are one of the most popular tools out there for fuel delivery companies. Remote, real-time tank monitors are not only more reliable than K-factors, but they create a pool of historical data to evaluate tank efficiency.

A majority of respondents use tank monitors in some capacity. Following the trend in last year’s survey, all respondents who currently use tank monitors either maintained or increased spending this year. The number of respondents not using tank monitors shrank by 3% over the past year.

In 2024, have you:

Number of responses: 102

Number of responses: 86

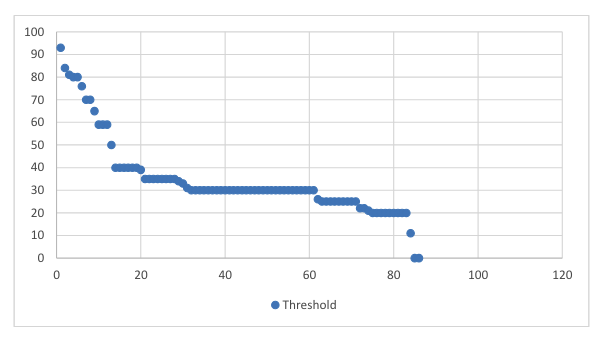

Every company uses tank monitors differently, and one of the main differences is the threshold set to trigger ticket generation. On average, respondents set a threshold of 34.8% full for delivery pulls; almost half of respondents have thresholds set between 30% and 35%.

Trend 1: Reporting

Modern software offers flexible reporting and dashboard capabilities to make data analysis a breeze. And by pairing strong reporting capabilities with cloud software and artificial intelligence, data is more accessible than ever.

How do you generate reports to evaluate company performance?

Number of responses: 102

Evolving technology has changed how fuel delivery companies generate and review performance reports. Manual data entry consolidation is down almost 7% from 2023, while third-party reporting tool usage increased by 10%.

Financial key performance indicators (KPIs) are the most-tracked metric to evaluate success. This prioritization makes sense given industry-wide concerns about inflation, employment, and the cost of living.

Which of these KPIs does your business measure?

Number of responses: 102

Trend 2: Areas of Growth

Do you struggle to get the data you need to evaluate your business performance?

Number of responses: 102

One-third of respondents struggle to gain business insights from their current data and systems, a challenge echoed in our 2024 report, where two-thirds were still seeking better ways to evaluate performance. 60% percent of respondents now prioritize advanced reporting and improved data accessibility to measure success effectively. For some, the data exists but is locked behind overly complex reporting tools, while others emphasize the need for real-time data access for service technicians, dispatchers, sales representatives, and accountants.

In addition to new data pathways, fuel delivery companies seek tools that the industry still lacks. Some of these tools are laggards compared to similar systems, while others are just starting to crop up in the industry (rollover images to learn more):

Advanced Operational Tools

(33%)Advanced Operational Tools

Energy companies want more out of their existing operational software, including advanced features for tank monitoring, routing, mobile integrations, and more.

Improved Synchronization

(11%)Improved Synchronization

Fuel dealers want the latest data faster than before and seek ways to integrate disparate systems and offer data access to everyone.

Marketing and Customer Experience Tools

(9%)Marketing and Customer Experience Tools

With customer service top-of-mind, fuel delivery companies are dipping their toes into marketing automation and customer-centric communications.

Artificial intelligence

(5%)Artificial intelligence

Not many respondents know exactly how they want AI to be used, but a handful believe it has a role in the fuel delivery industry.

Trend 3: Data Security

Cybersecurity has become a rising concern as the fuel delivery industry embraces new and innovative technologies. Companies are investing in various tools to protect data and retain customers’ trust.

Who manages your cybersecurity needs?

Number of responses: 102

Fuel delivery companies continue to favor internal IT resources, often using these in tandem with external resources to maximize security. The number of respondents with no cybersecurity resources has decreased since 2022, while in-house IT usage increased 8% since last year.

Have you experienced a cybersecurity breach?

Number of responses: 102

If you did experience a cybersecurity breach, did you lose business or revenue?

Number of responses: 16

16% of respondents reported having experienced a cybersecurity breach in the past. 44% of those respondents suffered a ransomware attack, while 38% fell victim to phishing. Ransomware attacks were more likely to result in lost revenue.

Brought to You by Cargas

This report is proudly presented by Cargas, leading software for fuel delivery and HVAC service companies. With tools for fuel delivery, customer service, HVAC service, and cylinder exchange operations, Cargas Energy helps fuel dealers do more with the resources they already have so they can grow their businesses.

Trend 1: Sales

Referrals and word-of-mouth advertising remain the most fruitful customer acquisition method for 98% of respondents. Social media usage is up 6% from last year, and cold calls are up 10%. This demonstrates an interest in diversifying sales efforts to improve revenue generation, all while meeting prospects and customers where they are.

How do you acquire new customers?

Number of responses: 102

How do you track sales opportunities and prospective customer information?

Number of responses: 102

Although spreadsheets and CRM systems remain the most common means of tracking opportunities, the use of fuel delivery software for sales and marketing is on the rise. Since 2023, more respondents report not using a specific system to track sales and marketing information, instead relying on data consolidated from multiple systems.

Trend 2: Marketing Automation

Marketing automation software helps fuel delivery companies automate email campaigns, social media activity, and lead tracking. It collects customer data to make personalization easier, which boosts efficiency and improves targeting to drive sales and customer loyalty.

In 2024, have you...

Number of responses: 102

Marketing spend skyrocketed in 2024, up 16% from last year. 16% fewer respondents maintained their current marketing spend this year, but fewer still decreased their marketing spend.

Despite a 2% dip in marketing automation tool usage, more than 40% of respondents continue to use these solutions to create content, communicate with potential customers, and track activities that help generate sales.

Do you use a marketing automation tool for emails, website forms, surveys, or activity tracking?

Number of responses: 102

What do you use your email marketing for?

Number of responses: 43

Of the 42% of respondents who use email marketing, 93% use it for two or more strategies. Competitive pricing, community engagement, and seasonal maintenance are the main drivers of email marketing usage.

Trend 3: Customer Experience

The fuel delivery industry has seen a digital shift in customer interactions since 2020. While energy companies still value strong customer relationships, self-service capabilities are increasingly important for customer retention and loyalty. 60% of respondents to this year’s survey measure customer satisfaction and retention as key business metrics.

91% of respondents use two or more tools for customer service, with phone and email communications being the most popular.

Across the board, customer service reps use more tools than ever to get the job done. This year saw increased usage of VoIP (9%) and social media (9%) for customer service. Although social media usage had fallen nearly 10% last year, it has bounced back to 2023 rates and is used by more than a third of respondents.

What tools do your customer service representatives use?

Number of responses: 102

What self-service options do you offer your customers?

Number of responses: 102

Although self-service offerings are slightly down compared to last year, rates for account management and autopay are still higher than they were in 2022.

Self-service tool usage rates are almost identical to rates from 2023, with 57% of respondents offering two or more resources for customers.

What tools do you use to provide these self-service options?

Number of responses: 102

Are you satisfied with the technology available for your industry?

Number of responses: 102

Respondents are more satisfied with available technology than they have been in years past. And this makes sense—with 71% of respondents increasing tank monitor investments, 52% increasing marketing spend, and 50% using fuel delivery software purchased within the past 7 years, modern technology is more pivotal than ever to an energy company’s success.

Almost two-thirds of respondents are actively evaluating new technology for the future. The tech they’re reviewing falls into one of four categories (rollover images to learn more):

Operational Software and Hardware

Operational Software and Hardware

Respondents are interested in everything from full-service fuel delivery software, like Cargas Energy, to tools for specific tasks, such as vehicle-mounted cameras, tank monitors, and routing solutions.

Customer-Centric Software

Customer-Centric Software

With fuel delivery companies continuing to focus on customers, it makes sense that respondents are interested in Customer Relationship Management (CRM) software for sales and marketing.

Payment-Specific Software

Payment-Specific Software

Cash flow is a top priority for fuel dealers. That’s why companies are researching internal financial software for bookkeeping and payroll alongside customer-facing software to expand payment options.

Artificial Intelligence and Automation

Artificial Intelligence and Automation

Beyond specific solutions, fuel delivery companies are interested in artificial intelligence and automation tools to handle repetitive tasks, streamline operational processes, and save time for team members.

What is the number one issue impacting fuel delivery companies today?

The issue of efficiency has always been top-of-mind for fuel delivery companies, but without an end in sight to issues of retention, inflation, regulation, and inventory, companies are trying to streamline processes for the back office, service techs, and everyone in between.

How many delivery trucks do you have?

Number of responses: 102

76% of respondents can be classified as small- or medium-sized businesses, with fleet sizes ranging from 1 truck to 20.

Where is your company headquartered?

Number of responses: 102

Most survey participants operate in the Northeast and Southern United States. Of the 45 respondents from the Northeast, 17 live in Pennsylvania where Cargas is headquartered.

Let’s Chat

Is Cargas Energy the right fit for you? Contact us to learn more.